A Temporal Filing System for Bills, Statements, and Other Information that Expires

I actually should be paying bills right now, but instead I’m preferring the procrastiductivity of writing about organizing your bills.

But then again, this is a post I’ve been meaning to write for months; so if I’m writing it now, is it still procrastination?

????

!!!!

As we ponder the philosophical knots binding the temporal yet distinct ontological states of producing versus procrastinating, we might seize gratefully upon a fact: Bills and financial statements have expiration dates!

And this means you don’t have to keep them forever.

Whew! That was my Alexander the Great moment, wielding a sharply honed fact to cut through the mental tangles of being and becoming, production and procrastination!

You don’t have to keep bills and financial statements forever.

This means you can file them temporally.

File Paid Bills Under the Month You Pay Them

I have happily been using my paid bills filing system since Alexander the Great sliced the Gordian knot.

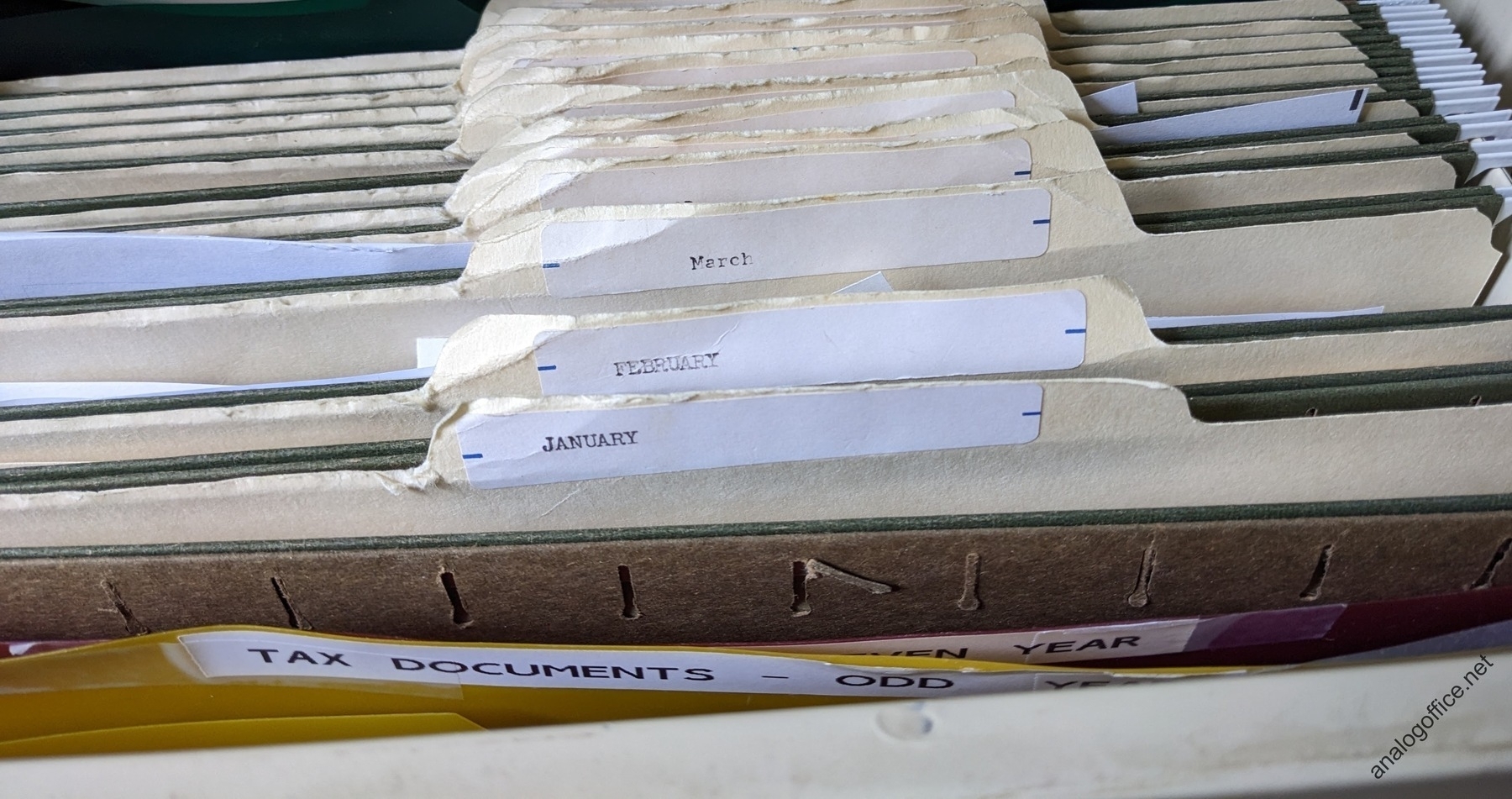

Behold the ancient wonder that is my temporal filing system, dating to the last millennium:

(And in the foreground you can see the tax document file jackets for odd and even years.)

These month files are for paid bills, in the current year. Whatever the current year may be.

I have a separate place where I store unpaid bills.

When it’s time to pay the bills, I get my unpaid bills folder.

I pay them online, I print out the confirmation numbers, I staple that to the bill statements. In the rare occasion that I have to write a check, I stamp the date it was paid and write the check number and the amount on the bill statement.

Then – the moment of triumph! – I stuff it all into the month folder.

But, alas, here comes another temporal philosophical conundrum! The bills could be filed by the month that you PAID them, or the month they are DUE.

What’s fastest and easiest for the bill payer? Filing them in the month you PAY them.

When I sit down to pay bills again later this August, some of them will have September due dates.

But if I paid a bill – any bill – in August, I stash it in the August folder. Even if it’s due in another calendar month.

Past due, future due, whatever – that’s the bill issuer’s temporal conundrum, not mine. It’s in the imaginal realm! Like time, itself!

As the bill payer, I don’t care when it’s due; I care about when I paid it.

I can look up when I last paid something in my budgeting program. The budgeting program doesn’t record the due dates. It records when I paid stuff. It’s easier for me to find the statement that way, on the rare occasions I need to check something.

So I file all my paid bill statements by the month I paid them, not by the month they are due.

Put a ‘Destroy By’ Date on Any Statements You Keep After the Current Year Ends

What happens at the end of the year?

At the end of the year they go into the Analog Office archives.

But not the permanent archives! Those are different file cabinets!

They go into the temporal archives file cabinet. This is the one I throw stuff in, that I will eventually take to the shredding company.

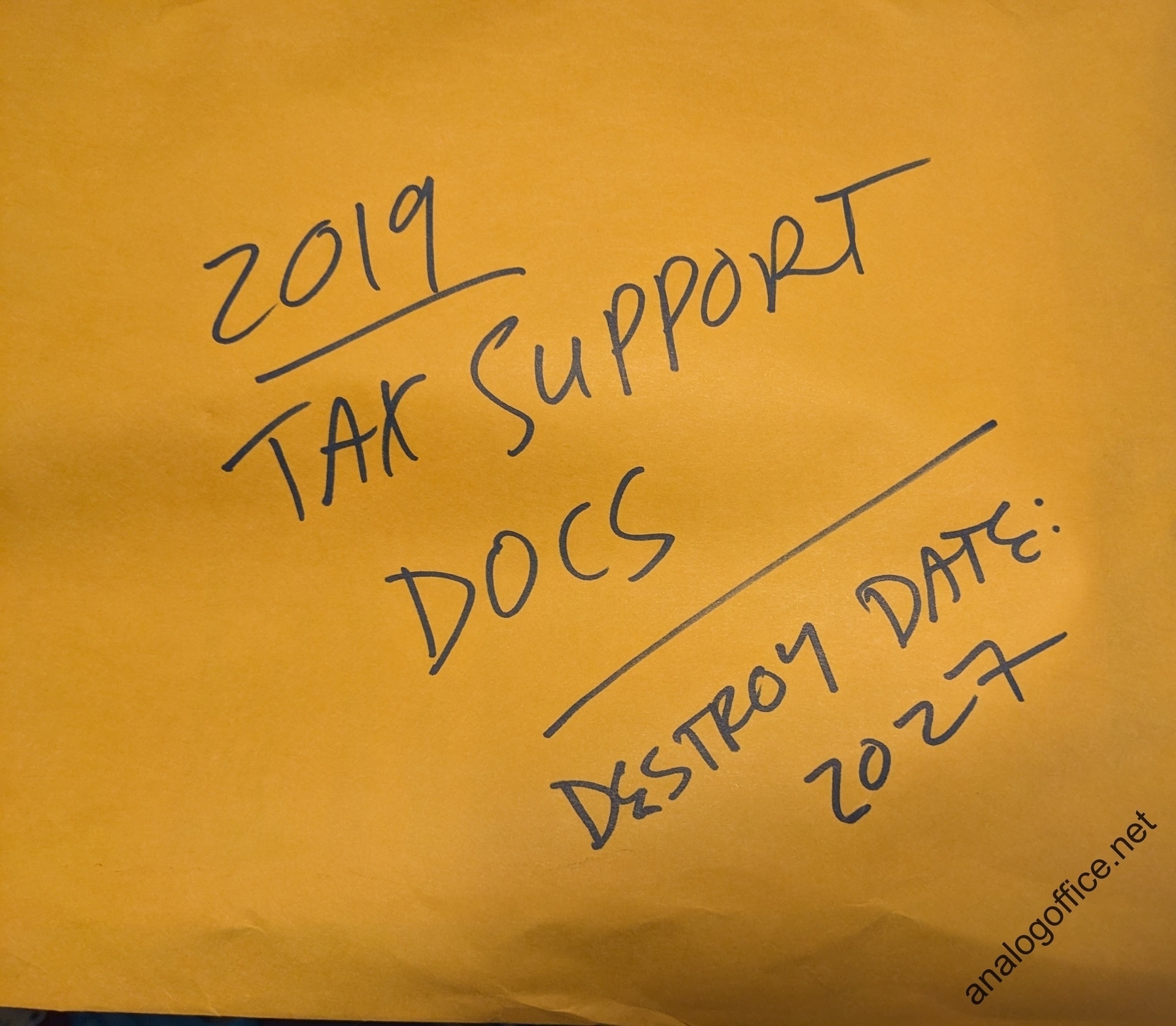

Check this out:

See the “Destroy by” date? I keep financial records that are connected with our taxes for seven years. In Year 8, I take them to the shredders.

I also don’t want to look at an envelope and wonder, more than once, when we can get rid of it. So I count the years out on my dainty little fingers one time, and then I write the date we can shred it on the envelope.

You might not want, or need, to keep stuff that long. But writing down a “destroy by” date tells you when you plan to get rid of it.

This “file-by-month (or year) and figure out a ‘destroy by’ date” system is also useful for recurring and regularly outdated things like bank statements and medical insurance payment statements.

You don’t need to keep those forever, either, but you might want to hang onto them for a time.

This system ensures that you won’t hang onto them forever.

… so, then what do you do with financial or legal papers you DO want to hold onto indefinitely, like a contract?

That goes into your reference files. I haven’t written about reference files yet, apart from the life-changing magic of keeping a file index.

I’m planning to, though!

Maybe I’ll get after it the next time I’m supposed to pay the bills….

Copy and share – the link is here. Never miss a post from the Analog Office! Subscribe here to get blog posts via email.

Wondering how to manage your paper-based or hybrid paper-digital systems? Ask me a question.

Reference

“Time, Real and Imaginary,” by Samuel Taylor Coleridge. Available at: https://englishverse.com/poems/time_real_and_imaginary (Accessed: 12 August 2023).

Also see: Analog Office - The Simplest Paper File System for using this system if you hate filing, but want a minimal system to help you find papers beyond bills.